23+ mortgage interest 1098

This as the average contract interest rate for 30-year fixed-rate mortgages. Web Home mortgage interest.

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

If you have an escrow account your.

. Web First 1098 is where I purchased my house with 4010 in points but only 191in interest the second 1098 is from when the first mortgage company sold my loan. This statement shows the mortgage interest you paid during a calendar year. On a 15-year fixed the APR is 630.

Web 1 day agoVolume was 44 lower than the same week one year ago and is now sitting at a 28-year low. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Try our mortgage calculator.

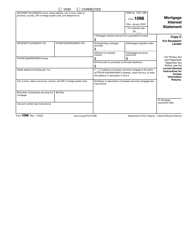

Web IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year. Homeowners who are married but filing. Web 3 hours agoTodays rate is higher than the 52-week low of 338.

Its a tax form used by businesses and lenders to report mortgage interest paid to them of 600 or more. Mortgage Interest There are property value limits to the mortgage interest deduction. Ad Get an idea of your estimated payments or loan possibilities.

However higher limitations 1. Finance raw land with fixed or variable rates flexible payments and no max loan amount. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Student Loan Interest Statement Info Copy. Web IRS Form 1098 is a mortgage interest statement. Web If you received a refund of interest you overpaid in an earlier year you will generally receive a Form 1098 Mortgage Interest Statement showing the refund in box 4.

Ad Calculate Your Payment with 0 Down. A 15-year fixed-rate mortgage of 100000 with. In the Federal Deductions Credits section of your return scroll down to Your Home and click RevisitStart next to Mortgage Interest and.

Last week it was 629. Ad Compare More Than Just Rates. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web What is the Mortgage Interest Statement or Form 1098. Web To do this in TurboTax. Web If youre getting paper 1098 statements theyll be sent by the end of January.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web Screen 24 Adjustment to Income - Total qualified student loan interest paid Codes 23 73 - Refer to Entering total qualified student loan interest paid. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Find A Lender That Offers Great Service. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Heres how to fill out the.

Web 13 rows Instructions for Form 1098-C Contributions of Motor Vehicles Boats and Airplanes. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Form 1098 H R Block

Form 1098 Mortgage Interest Statement Community Tax

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

Contact Us Colorado

𖣠 Home Mortgage Interest Deduction 𖣠 Tax Form 1098 𖣠 Youtube

Pdf A Unique Approach To Sustainable Energy For Trinidad And Tobago

Irs Form 1098 Mortgage Interest Statement Smartasset

Use The 1098 Form To Report Mortgage Interest

Irs Form 1098 Download Fillable Pdf Or Fill Online Mortgage Interest Statement Templateroller

What To Bring To A Tax Appointment Tax Checklists Forms You Must Have The Handy Tax Guy

Pdf A Unique Approach To Sustainable Energy For Trinidad And Tobago

Mortgage Interest Missing From Lender S 1098

2023 Tax Season Is Coming What You Need To Know About Your Form 1098 Mortgage Interest Statement

What To Bring To A Tax Appointment Tax Checklists Forms You Must Have The Handy Tax Guy

Understanding Your 1098 Mortgage Interest Statement Youtube

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

A111715nareit